by Andrew Lee

My thesis is web3 social will be about having dedicated social applications for sharing, discussing and reacting to NFTs, specifically across two verticals: GameFi and art collectibles.

Twitter is an amazing place for broadcasting updates to others, but it’s incredibly lacking in features and UI/UX that make it the most compelling place for socializing around NFTs. For example, it’s not built to be a very visual feed and it’s mostly text-based. Also, because Twitter is not a place for discourse exclusively around NFT collectibles, there is a lot of noise and random banter that make it unattractive for people looking to specifically socialize online about NFT collectibles.

With the problems above in mind, I believe there will be a product opportunity for someone to build a Pinterest or Tumblr-like web3 social network for curating NFTs, writing about them, and reacting to other people’s content. I also believe that this type of web3 social network won’t be focused about “flexing,” as in showing off expensive NFTs to others. Flexing is a zero-sum game that makes a lot of people feel left out and inspires feelings of jealousy. Therefore, a critical feature to such a social network would be to allow people to share and curate NFTs they don’t own as well.

The clout or credibility that people would work towards accumulating on this platform would be for being recognized and acknowledged for their unique taste and opinions, similar to popular Tumblr bloggers years ago.

The enthusiasm to share and discuss art amongst the NFT early adopter Telegram and Discord communities is extremely high. Also, the enthusiasm and passion to discuss NFT art at in-person meetups and conferences is also very high. I imagine such discourse and networking can be translated extremely well for a more visual plus social orientated product built for this.

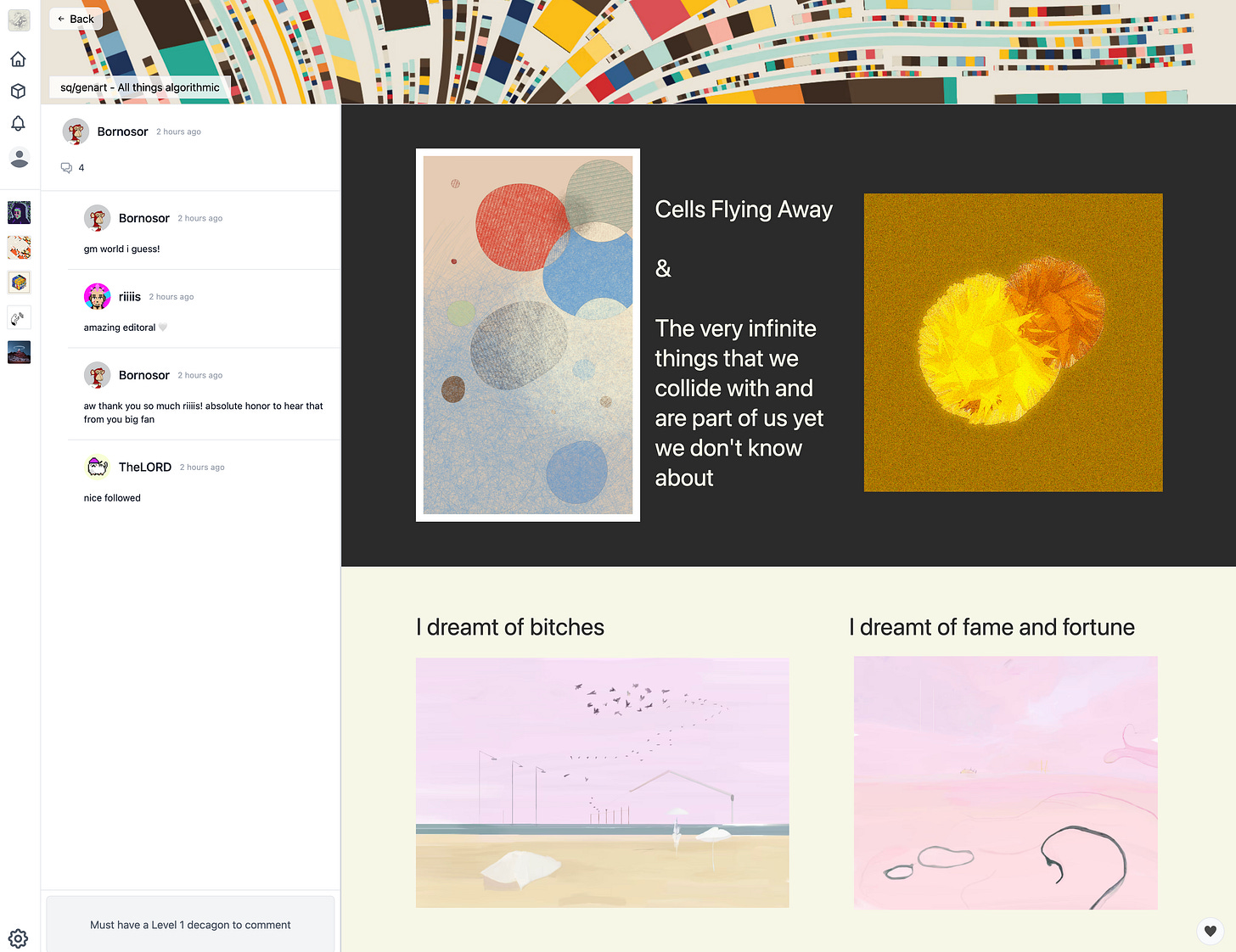

My good friend Samuel McCulloch has been an incredibly insightful and early-to-the-trend friend who’s been in the space for over a decade now, and he shared with me some of the earliest ICOs back in 2017, told me to mint BAYC (which I didn’t), and he also shared with me a new web3 social platform called Deca.art which inspired me a lot. Deca.art is the closest product I could find right now that reflects my vision above, and I think it has tremendous potential to be a vertical specific web3 social application for NFT discourse, curation and socializing.

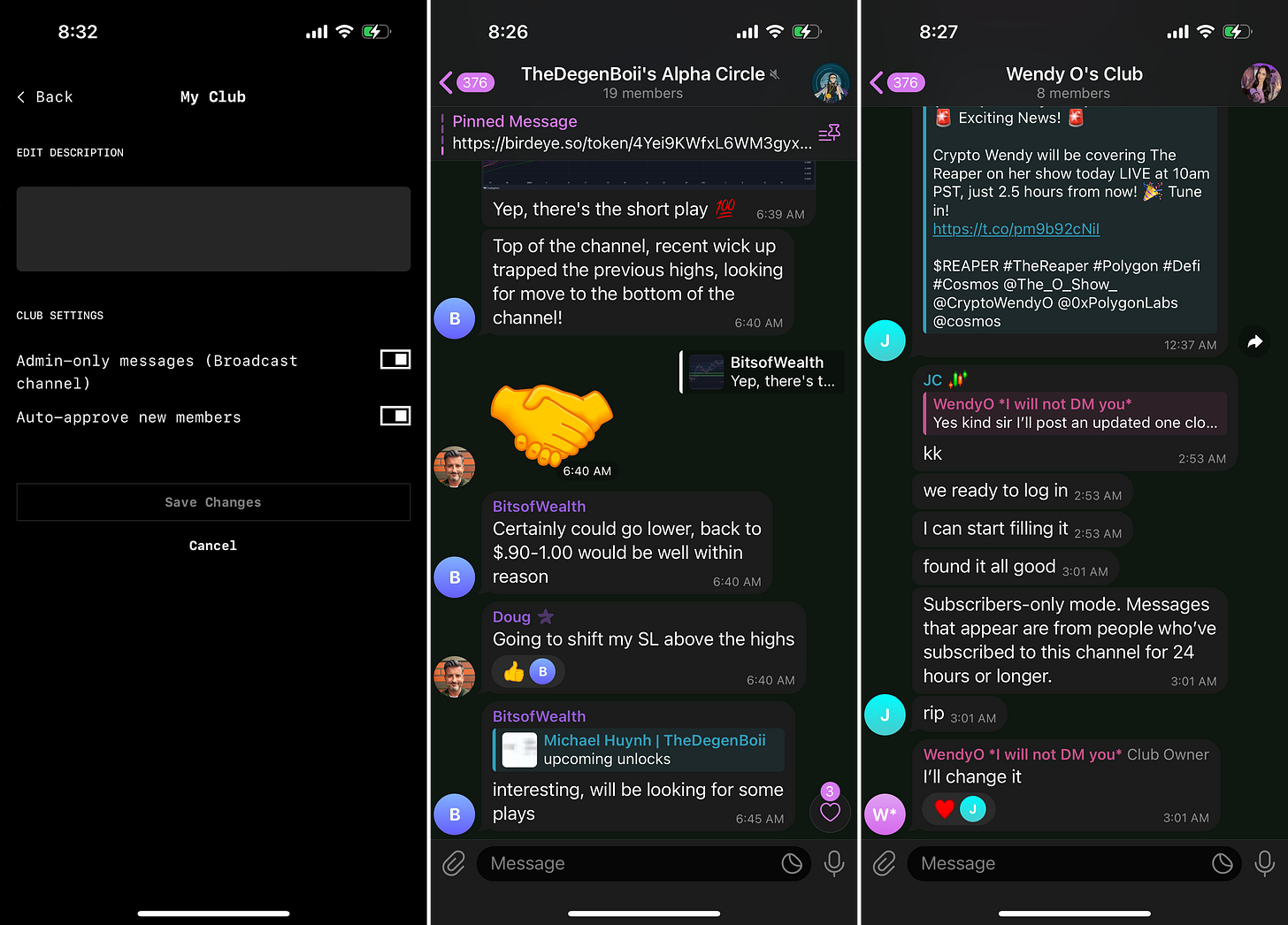

NFT collectors are writing about art and curating pieces they like on Deca.art.

I believe Twitter always has its place in crypto and won’t be replaced. It’s good for being the global social graph for all of crypto, and it’s also the right place for unfiltered banter about anything, including trading, investment tips and market commentary. But for many, Twitter is too fast paced, too casino-like, too noisy, too angry, and they’re passionate about the art exclusively. For that, I believe a dedicated application needs to exist for both art collectibles as well as gamefi collectibles. It’s early for GameFi, but I believe eventually people will enjoy sharing their GameFi collectibles as well. Everyone will have a portfolio of art NFTs and GameFi NFTs eventually.

My friend Samuel also introduced me to a generative NFT artist named Zancan, who had this amazing feature on his personal site that lets owners of his art order a signed official print from him, limited to a certain number of editions. I was always skeptical of the utility of NFTs because just holding them in a wallet did not really make that much sense to me immediately. However, with the added utility of being able to use the token to order an official print directly from the artist, I am a lot more sold.

Zancan.art has token-permissioned ordering of a signed print, limited to a number of editions.

What’s great about NFT artists and collectors is how they are a direct relationship from the creator to the fan, without any middlemen, agents or 3rd party agendas in between. I believe the future of NFT trading and collectibles will have an emphasis on transparency for the collector, which is a major value proposition for blockchain assets in general. On the other hand, crypto projects that are opaque and have early insider agendas, I believe, will have a harder time gaining fans in the next upmarket cycle.

Also, I decided to share my list of top signals that I saw in the market around early November 2021. A lot of my readers found this interesting on Telegram so I thought I’d share the totally unfiltered notes below!

1. Crypto bull cycle phases

Crypto tends to cycle in the following phases:

Building real stuff and curiosity >> making easiest money ever >> losing some money and being peak greedy and a compulsive gambler and copy trading people

2017:

Exploring ICOs >> easy 5–15x ROIs >> bleeding in 2018 and copy trading ICO influencers

2021:

Exploring alt coins and big caps >> easy money >> bleeding on chop volatility and copy trading 3AC

Every time people come to deterministic relationships in investing, it’s just a massively bad sign.

We have way too many CT traders calling directions right now and engagemnet fishing it’s crazy.

2. Volume is not like it was in May

Crypto volumes are nowhere near where they were in May 2021, especially for alt coins. Coinbase retail numbers are down in Q3.

3. We are still running on high leverage dirty bitmex-style CEXes

Leaves us vulnerable to liquidations and a series of cascading longs

4. Everyone is targeting $100k BTC $10k ETH and “2 more months of inflation”

Earlier in 2021 no one knew we could go to $60k BTC $4k ETH then massively correct in just a few weeks; that’s because there’s not enough liquidity for everyone to magically sell $100k btc and live their fancy life w/ mansions and jets; the market will do the unpredictable because crypto is not liquid enough to make everyone win.

5. Everyone things Fed is predictable

Absolutely insane that people think they can time the Fed; sure inflation may be the trend and macro may be going up, but crypto can cycle and nuke many times while stocks do something else, and stocks can retrace at any given time without giving a moment to exit.

6. Fundamentals aren’t that great…..

All the stuff people are fomo’ing over is really old stuff but just incredibly over valued right now; solana is way over valued for being a NFT chain which is practically dying right now. Everything is just crazy overvalued while BTC is doing yet another cycle.

7. Risk is actually being ignored and not well understood

It’s exactly when everyone feels like markets are a sure bet is the time when risk has been compounded to be the highest; a steady upwards chart when everyones just adding to longs to make free money is exactly the riskiest time to be in the market.

8. The black swan is everyone thinks everything is so predictable!

When everyone is pushed so confidently in the same direction — looking up for $100k btc and fighting inflation, it’s peak greed.

9. Euphoria at crypto conferences around the world

Everyone is just traveling the world just like 2018, very passively managing a very aggressive long shitcoin portfolio. If history repeats, their net worth evaporates before they know it.

10. Founders have no incentives to build.

Founders are tempted to invest in shitcoins right now instead of building because it makes easier money.

11. We have buzz words no one understands.

“Web3” and “metaverse”

12. Leverage is peaking.

Open interest, funding rates, futures are all high

13. The asymmetric risk is gone.

The time to get long as when there were multiples more upside, but we already went from $3k to $60k btc with only 5 months of consolidation, it’s very possible we range for a while to shake people out of their new wealth first before we do another parabolic bull run again (which will come again, one day).

14. Financial manias are always when people are thinking “this is the new norm”

In the present, we all think oh nothing is wrong, this is the new normal; but this is how all financial manias are, there is some catalyst or narrative that drives EVERYONE to think the same way, which seeds the potential black swan event.

15. Legacy shitcoins pumping

Bitcoin cash is up. Classic top signal