How I'm Building Out SoFi (Social Finance)

by Andrew Lee

DeFi today has provided utility for a lot of the same use cases that CEXes have already validated, which includes spot trading, margin lending and leverage. Many DeFi startups today are building more specialized solutions for an already small demographic of advanced crypto users, and are not thinking about how to grow the dapp user population as a whole. In light of this limitation of DeFi serving a very niche audience, I think the next area of growth for crypto applications lies in the intersection of social needs and crypto assets.

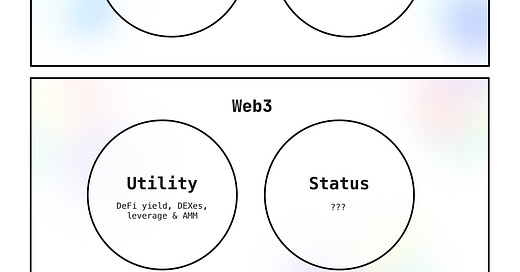

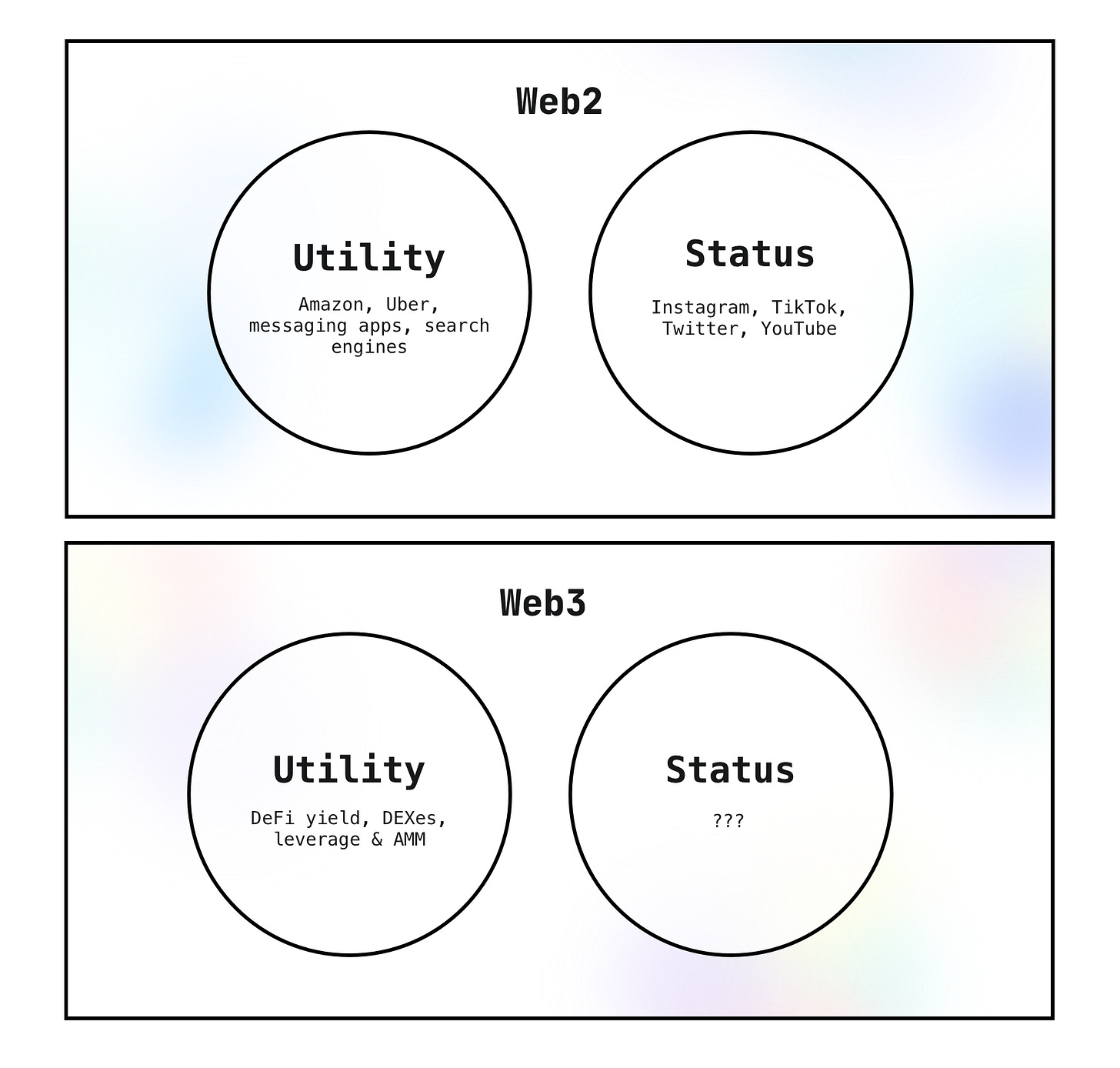

If you look at Web 2 today, I would suggest there are two major categories of successful applications: one is utility, the other is status games. In the utility category, I believe marketplaces such as Amazon, Uber, eBay, and Airbnb would be a good fit, as well services like Google and Spotify. On the other hand, I believe there are very successful “status” incentivizing applications that drive endless engagement and competition among users. Examples include Instagram, Twitter, TikTok, Snapchat, and YouTube. The users on these platforms will work all day for free to collect status points in the form of likes, comments, follows and other actions of engagement and approval.

In a similar light, I see DeFi being very successful at dominating the utility around trading of crypto assets. I’m confident DeFi will continue to grow and become more resilient and innovative over time and the huge exploits will be a thing of the past.

However, equally as exciting to me is the untapped potential on how we turn crypto products into a “status” game. What does the social, or “status” layer of crypto look like? What is the Social Layer of Ethereum?

I anticipate the following use cases below will be some of the best leading examples of what SoFi (Social Finance) is:

DAO clout. Creating a DAO or being part of a DAO will be a way to signal one’s network, individuality and identity. It will become a status symbol to have create a very successful DAO, or one of the top 5 DAOs in the space. I imagine it soon being a common behavior for most people in the cryptocurrency investor space will be in part of at least one DAO.

NFT trophy room. People will adopt a type of “Web3” social profile that will allow them to host a trophy room for the Web3 assets, including NFTs, DAO tokens, project tokens and more. The typical user behavior today is to keep wallets anonymous, but I anticipate the ownership of crypto assets will become a more of a community-centric and social activity. People will find the need to build and promote their Web3 footprint.

Purchasing NFTs for subscription access and finite access to content. I believe one of the next major behaviors in crypto that has yet to unfold is the use case of NFTs being used to unlock subscription access to content or applications, similar to Patreon or OnlyFans. Crypto has grown to a big enough population now that allowing content creators to collect revenue via customers wanting to pay via crypto wallet like MetaMask and own a NFT is mature enough now. Learning from Web2, simply selling digital goods like Gumroad wasn’t nearly as successful as selling finite subscription-based services like Patreon and OnlyFans. I imagine it will be the same for crypto, but even better since crypto has potential to be fee-less with zero middleman fees.

My project, DAOfi is in the early stages of shipping products in all three of the categories above. Our roadmap, which could change, includes:

A leaderboard of the top DAOs in the space in partnership with Carlos from Forefront.market.

A customizable landing page called myeth.id that will let users showcase their NFTs, DAO tokens, project ERC-20s they support, and social tokens they own.

A DEX that will let creators sell a NFT for subscription access to a service, content or applications. We will provide the end-to-end user-experience to create such token-permissioned content experiences, and will charge zero fees for trading on this NFT DEX.

Screenshots below!

All of these products mentioned above will utilize DAOfi tokens in some way, either through fees or staking. Also, note, these are early stage ideas and may be executed differently, or not at all if strategies change based on user data.

I don’t anticipate the Web3 “social” app to be a decentralized version of Facebook running on Ethereum and IPFS. The crypto version of social networking will closely integrate with Ethereum wallets, NFTs, DAOs and will leverage DEXes as the plumbing and piping to provide liquidity for all these assets. I see a future where a “user-owned” web doesn’t necessarily mean a “decentralized [insert social media monopoly here]”, but it will rather thrive on the theme of personal custody and self sovereignty. For example, a user will truly *own* their Ethereum wallet, will *own* the DAO tokens they’re entitled to have access to, will *own* NFTs that give them either ownership to digital art, or access to digital services and beyond. The most unique characteristic of blockchain is that a decentralized database very programmatically verify digital assets are scarce, exclusive and verified. These qualities have major potential for adding value to Web 2 experiences, and will add a lot of value to web use cases around exclusivity, virtual clout and status, and permissioned-access.

If you believe in our roadmap and want to be an early-user and adopter to these products, we’d love to have you in our community on Telegram and Discord. We believe in the ethos of building in public, which means transparently sharing our learnings and iterations as we evolve DAOfi. DAOfi’s ultimate vision is to bridge the gap between Web 2 social and crypto.

Thank you!

🔗 DAOfi Links

https://daofi.org/

https://twitter.com/daofidex

Uniswap: https://app.uniswap.org/#/swap?inputCurrency=0xd82bb924a1707950903e2c0a619824024e254cd1

Contract: 0xd82bb924a1707950903e2c0a619824024e254cd1

Telegram: https://t.me/daofi

Discord: https://discord.gg/5ndaWRF

Testnet Alpha: https://app.daofi.org/